SAAS

SAAS

22 February, 2024

SaaS Payment Solutions provides companies with different tools for precise payment and subscription management. A company struggles the most when they have to choose one SaaS payment facilitation solution.

You made a great SaaS product, but getting paid feels confusing. You will find many payment solutions for SaaS.

I will share the top 10 types of payment solutions for SaaS. Here, you will also learn some pros and cons for each type. Let’s start the discussion with the definition of SaaS payment.

SaaS payment is the method used by subscription businesses to charge customers regularly for accessing their services. These businesses use SaaS platforms to handle regular billing and manage customer subscriptions by sharing payment details with banks.

Unlike one-time purchases in e-commerce, SaaS payments are ongoing. This payment process reflects the subscription model commonly used by SaaS businesses.

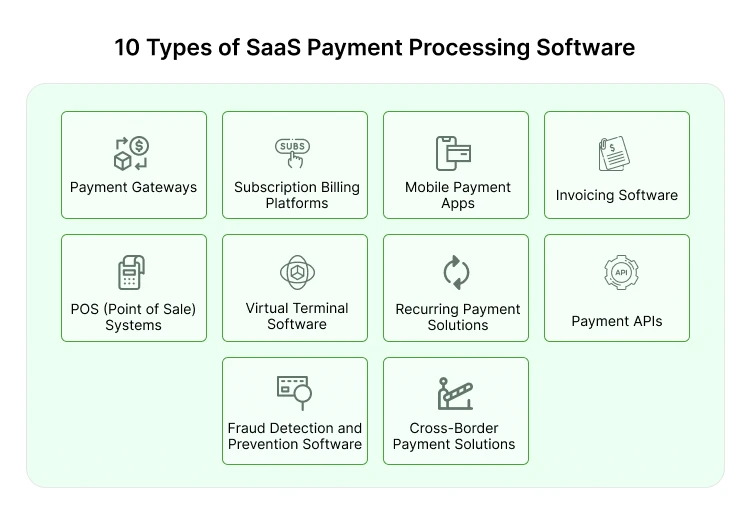

Learn about the 10 types of SaaS payment Solutions or you can call it SaaS payment processing software together in the next section.

Any plan for starting a SaaS business? Then you must know SaaS payment processing software. Knowing all these types of payment software helps to choose one type of solution that solves all your payment issues.

Have a look at these types of payment processing software:

A payment gateway is an online service that facilitates the secure processing of electronic transactions, such as online purchases. This is one of the first SaaS payment solutions on this list. It keeps customers’ payment info safe and sends it between the merchant’s website and the bank. This action ensures smooth money transfers.

One example of a SaaS payment gateway for supply chain SaaS is Stripe, which offers easy integration, robust security features, and support for various payment methods. Another example is PayPal, known for its widespread acceptance, user-friendly interface, and buyer protection policies.

SaaS subscription billing Platforms are how companies charge for their software services, with customers paying regularly instead of all at once. It is important for SaaS businesses because it brings in steady, predictable income.

Subscription billing software automates tasks like sending invoices and collecting payments, acting like a helpful assistant. This saves time and money by reducing manual work.

These billing platforms make managing subscriptions, sending invoices, and processing payments easy. They also help companies keep accurate financial records and stay compliant with industry regulations.

Mobile payment apps are digital tools that let you make financial transactions using your smartphone or other mobile devices. They are easy to use because they allow you to pay for things and manage your money without needing cash or physical cards.

Invoicing software SaaS payment facilitation solutions make business invoicing easier. They help create invoices, handle recurring payments, and maintain accurate financial records.

Users can personalize invoices with their company logo. They can choose from different templates, and add payment details with ease. This software works as your virtual assistant for managing invoices. Usually, it ensures everything looks professional and organized without any hassle.

Are you looking for the best payment solution for SaaS for invoicing software? Try Ordway, Maxio, and Stripe as they are the best SaaS invoicing software. Through SaaS distribution channels you can get this software.

POS (Point of Sale) Systems SaaS payment solutions revolutionize the way businesses handle transactions and manage their operations. These systems operate via the internet, allowing users to access them from anywhere, anytime.

They offer features like inventory management, sales reporting, employee scheduling, and robust security measures to safeguard sensitive data.

Examples of POS (Point of Sale) for SaaS

Virtual Terminal Software is one of the types of SaaS payment solutions, that acts as a digital cash register accessible through a web browser. It is easy to use for businesses handling various payment methods.

It gives phone orders or in-person transactions without physical card readers. While it needs an internet connection to work, it offers flexibility in managing payments.

However, it is important to prioritize security measures like PCI-DSS compliance to protect customer data during manual card entry.

Payanywhere, SimplyPayMe, and SwipeSimple are the three best examples of this software. If you are planning to use one, choose from these three.

Recurring Payment Solutions as Systems (RPSS) make collecting repeat payments from customers easier and more efficient for businesses. They come with various features to make things convenient, secure, and smooth.

RPSS offers different payment methods and is easy to integrate into existing systems. This automation helps businesses manage recurring payments better, improving cash flow and reducing the need for manual tasks.

While they offer numerous benefits, businesses should carefully assess their needs. Remember, you must consider factors such as security, and cost when choosing an RPSS provider.

Payment APIs are software tools that make it easy to add payment processing to websites, mobile apps, and other software. They act as connectors between merchants, customers, and payment services. It ensures payments happen smoothly and securely.

One great thing about Payment APIs is they offer different ways to pay, so everyone can use their favorite method. They also make the checkout process smoother for both sellers and buyers.

Here, you will get some extra features like spotting fraud and helping with chargebacks. These features make payment processing safer and more reliable. Stripe and Chargee are the two best examples of SaaS payment APIs.

Fraud Detection and Prevention Software, especially those available as SaaS solutions, is essential for keeping businesses and individuals safe from online fraud. These programs use advanced technology like real-time identity checks and behavior analysis to stop fraud.

They also offer tools for managing fraud cases and generating detailed reports. This makes it easier to investigate and follow regulations.

Overall, they are important for fighting online fraud effectively and keeping digital spaces secure for everyone. So, ClickGUARD, Forter, ClearSale, etc are some best options for this software.

Cross-Border Payment Solutions are like handy tools that help businesses and banks deal with international payments smoothly. They use fancy technology to quickly convert different currencies and offer good rates.

This helps businesses make more money from currency exchanges. These solutions also let businesses adjust settings to save money and manage risks better.

Chargify, Chareover, and Invoiced are some of the best examples of SaaS payment solutions. You can go for any of these that go with your needs.

Finally, if you are looking for the best SaaS payment solutions, you can choose from these 10 types of solutions. Go for the one that suits your business the best.

From gateways to billing platforms, each choice has its advantages and drawbacks. Whether you are looking for the easiest one to use, security, or savings, there is a solution for you. To understand SaaS b2b’s meaning, try any SaaS payment software.

Take your time, go through the pros and cons, and then choose one. Don’t hesitate to ask for advice from an expert. Choosing the right payment solution helps you to bring success to your business.